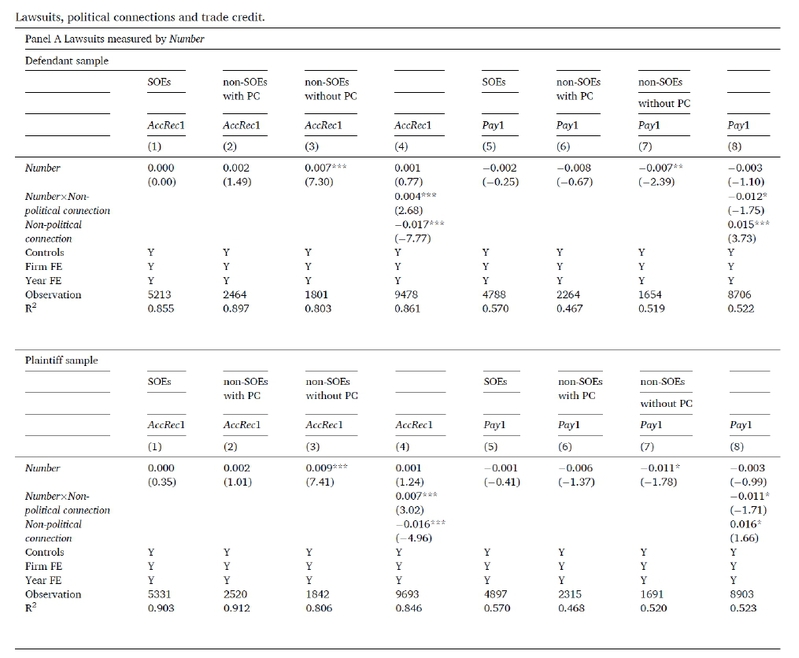

This paper explores the interplay between politics and law enforcement in China and its effects on firm financing decisions. By examining a sample of corporate lawsuits involving listed firms in China, we find that politically connected firms are less likely to be defendants, have higher win rates, and experience shorter litigation durations than non-connected firms. Additionally, we observe that firms with higher legal risk extend more accounts receivable and receive less accounts payable, but this relationship holds only for non-connected firms. Our findings support the financing advantage theory for politically connected firms and the legal risk compensation view for non-connected firms. Moreover, reforms in China’s judicial system do not appear to mitigate the disadvantages faced by non-connected firms in terms of lawsuit outcomes and trade credit provision. Our findings suggest that well-functioned judicial independence might be still lacking in China, and that political connections continue to negatively impact law enforcement and corporate policies.

If you are interested in the research, please read the paper:

Miao, Senlin, Zhu, Zhaobo, Deng, Wesley (Xiaohu), & Wen, Fenghua. (2024). Law, politics, and trade credit in China. Journal of Corporate Finance, 88, 102643. DOI: https://doi.org/10.1016/j.jcorpfin.2024.102643

A full version of this article could be viewed at:

https://www.sciencedirect.com/science/article/pii/S0929119924001056

Nanjing University of Aeronautics and Astronautics

Copyright 2017 | All Rights Reserved with NUAA